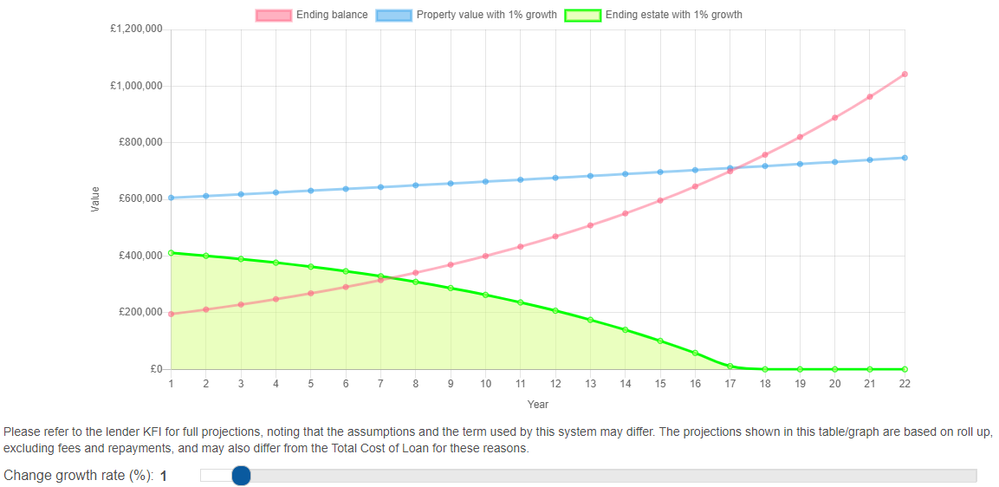

Providing insights into the actual cost of products, and the amount that would need to be paid back at a certain age, helps consumers better understand the options available and how they compare to each other.

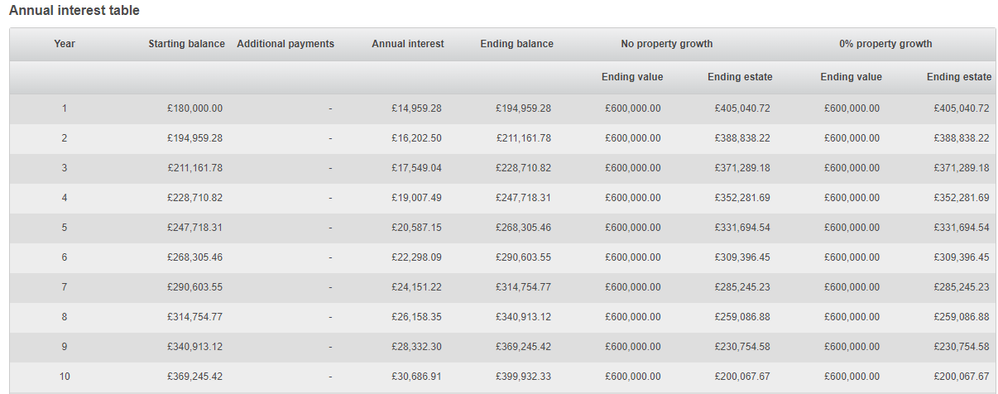

By showing the impact of compound interest and how the loan could roll up to a higher amount than expected, demonstrates how rates and fees can impact the size of the loan in future.

These insights are key to ensuring customers understand products as fully as possible, and therefore to achieving this outcome.

Key Features

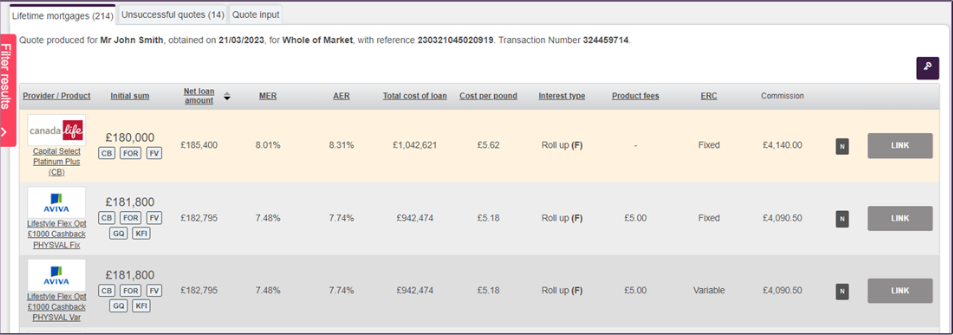

Net loan - true amount that can be borrowed by the policyholder(s)

Net loan - true amount that can be borrowed by the policyholder(s)

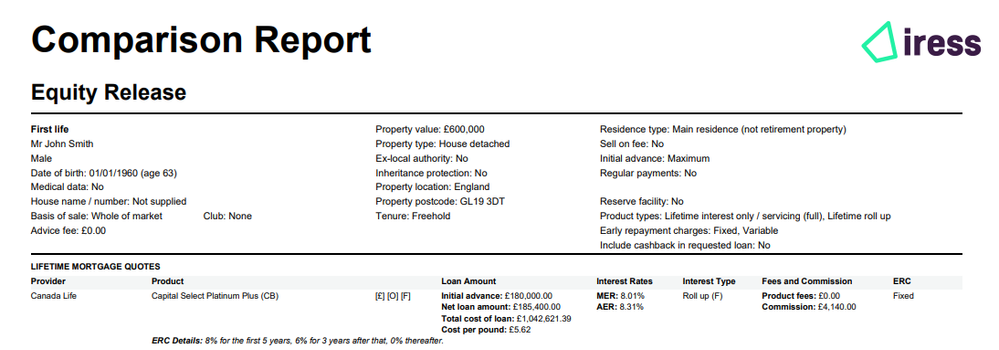

Total cost of loan - total amount that will need to be paid back if the policy continues to assumed term

Total cost of loan - total amount that will need to be paid back if the policy continues to assumed term

Cost per pound - the amount that needs to be paid back for each pound borrowed; a strong indicator of value

Cost per pound - the amount that needs to be paid back for each pound borrowed; a strong indicator of value

Annual interest - shows the impact of rolled up interest on the term of the mortgage

Annual interest - shows the impact of rolled up interest on the term of the mortgage

Model growth rate - allows you to review the impact of house growth rates on the equity remaining

Model growth rate - allows you to review the impact of house growth rates on the equity remaining

Next Steps

If you would like to know more about how Iress The Exchange can support you deliver the principles of Consumer Duty, then please contact your Iress representative.

Alternatively, our team of experts are here to help you

Email - sourcingadoption@iress.com

Call us - 03450 530 490