Overview

We are pleased to announce that Nationwide is now available via Lender Connect in XPM. Nationwide joins TSB, Accord Mortgages, Leeds Building Society and Aldermore in offering brokers faster mortgage applications through Lender Connect.

This means brokers will be able to capture all the data required to submit a Decision in Principle to Nationwide and receive an immediate decision back all from within XPM. Brokers will then be able to proceed to NFI Online from XPM to continue the application journey there.

The ability to submit Decision in Principles to Nationwide from XPM is an important step in our journey in speeding up the mortgage application process - and we are bringing onboard more lenders in the near future.

Contents

See it in action

User Guide

You can now complete and request a Decision in Principle from Nationwide directly within Xplan Mortgage. Following a successful Decision in Principle you can also continue the application process in NFI Online, launching from Xplan Mortgage.

Why should I use it?

- Get a Decision in Principle without leaving Xplan Mortgage

- Simple, intuitive and easy to navigate screens

- Fits seamlessly into your current Xplan Mortgage fact find, sourcing and application process

- Information already keyed into the fact find is pre-populated for a quicker Decision in Principle

- Proceed the application from within Xplan Mortgage and we’ll speed things up by copying across all the client information you’ve already keyed directly onto Nationwide's portal

What Nationwide products are available via Lender Connect?

- Standard Residential Purchase

- Standard Residential Remortgage

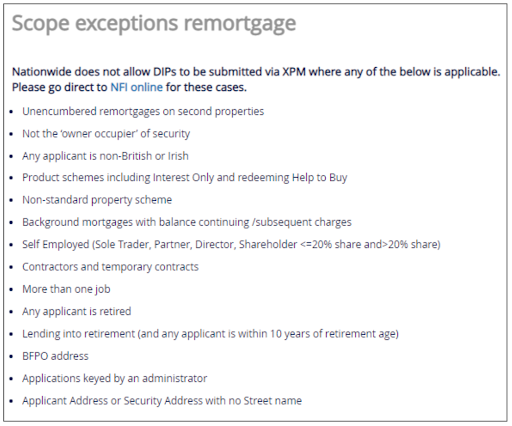

What products are currently excluded?

Nationwide cannot currently support the following products via this route. You will need to visit NFI online for these types of cases.

- Product Transfer

- Further Advance

- Interest Only

- Product Schemes (including Helping Hand, Deposit Unlock)

- Property schemes (Shared Ownership, Equity Share, Right to Buy)

There are also some scope exceptions for Purchases and Remortgages and these will be flagged in the process.

How do I use it?

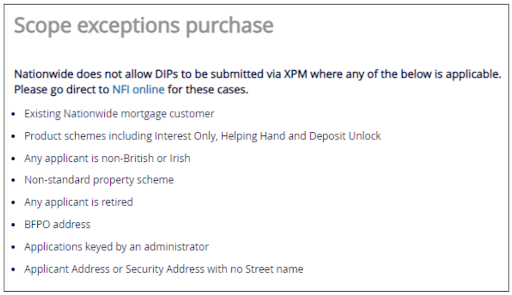

1) Select a Nationwide product from the sourcing results. Lender Connect enabled products are indicated with a Green tick.

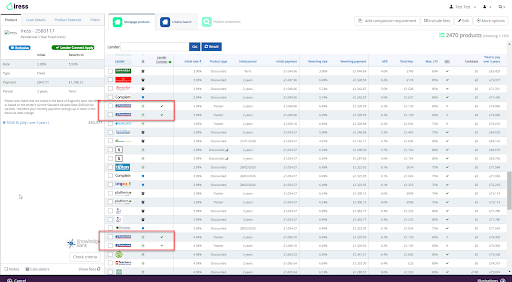

2) Select ‘Lender Connect Decision in Principle’ on the illustrations page.

If your case is not suitable based on Nationwide's current scope exceptions you will see an error message to prevent you proceeding within Xplan Mortgage. You will need to visit NFI online as you do currently to submit for these cases.

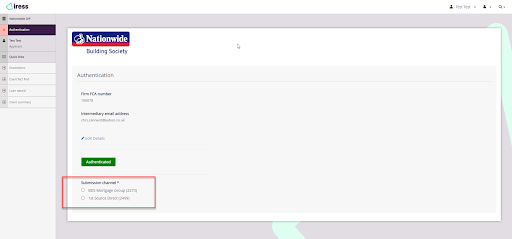

3) The next step is to authenticate with Nationwide and choose the submission route

If your firm FCA number and email address has already been added to XPM, then XPM will automatically authenticate you with Nationwide and return a list of the submission channels for you to select from.

If you have not previously entered this data, then you will be able to enter the data on this page. Simply enter your firm's FCA number and email address, then you can click the ‘authenticate’ button.

You’ll then see a list of submission channels, select the applicable channel and then click ‘Save’ in the bottom right hand corner of the page.

4) Enter your case information into the Nationwide question set. Some data will already be pre-populated from the fact find and mortgage sourcing. Mandatory fields are indicated by *.

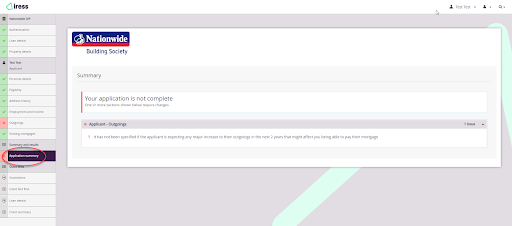

You can complete the pages in any order. The application summary screen will tell you which data is missing and when all mandatory data has been completed. An example of the application summary screen advising that data is missing:

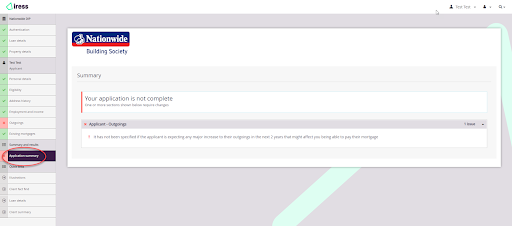

An example of the application summary screen when all data has been successfully completed:

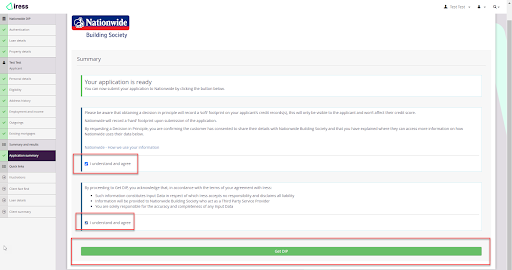

5) When all mandatory fields have been completed

- Select the green tick to agree with the required disclaimers.

- Select ‘Get Nationwide DIP’ to submit the DIP request.

- The response could take up to a minute to arrive back in XPM, but usually should take under 10 seconds.

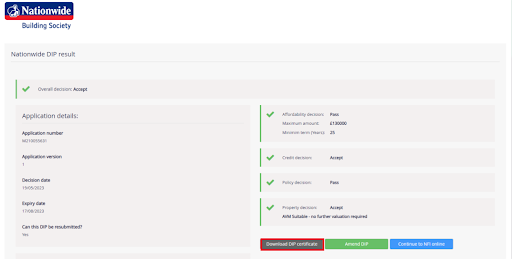

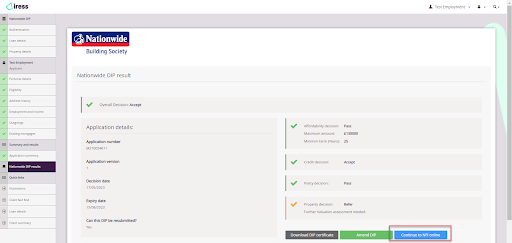

6) The DIP result will now be displayed on screen, with a DIP certificate available for a one time download for a purchase application.

7) Following an accept or refer decision you can continue to NFI online to continue the application process in NFI Online.

- Select ‘Continue to NFI online’. This will route you to NFI online, where you can login with your NFI online credentials and continue the application with pre-populated data.

- The DIP questions will be pre-populated from Xplan Mortgage. You will need to step through and request the DIP again before proceeding to product reservation and FMA. Nationwide plans to make a change in due course to bypass the DIP pre-pop and to enable you to go straight to product reservation. Please note that for remortgage applications, Nationwide will round the time at current address up to 3 years if it is less than 3 years when pre-populating into NFI online.

- If you can’t see your case immediately in NFI Online, your NFI online Case reference will be stored in XPM. You can easily switch back to the tab with XPM to copy and paste the case reference into NFI Online.

IMPORTANT

- If you do not click ‘Continue to NFI online’ within Xplan Mortgage and navigate to NFI online directly you will not benefit from pre-population and all your case data will need to be re-entered.

Note that the DIP Application number is different to the NFI online case number which is only generated after you have clicked ‘Continue to NFI Online’.

Note: Some cases can be edited after submission. If the DIP result from Nationwide indicates that you can make changes to the data to resubmit, you will be able to edit most (but not all) of the data previously entered. If you need to change loan detail information, you will need to go back to XPM sourcing and source again. If this results in you recommending a different Nationwide product, then when you click the ‘Lender Connect Decision in Principle’ button on the illustrations page to open the Nationwide DIP question set, all the data you previously entered will be pre-populated, including any changes you have made to loan details in sourcing.

If you do not immediately wish to proceed to product reservation and FMA, then the DIP results page will be accessible from the illustrations page whenever you are ready to proceed. Clicking on the FMA button will take you back to the DIP results page and enable you to click on the ‘Continue to NFI online’ button. Then simply follow the steps in point 7.

Pre-requisites

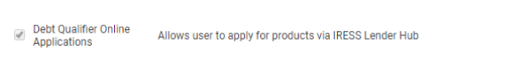

The ‘Debt Qualifier Online Applications’ capability within Xplan Mortgage must be selected in order to use Lender Connect.

Further Support?

If you would like further information or support about Lender Connect please contact mortgagesupport@iress.com